Alternative Minimum Tax (“AMT”) is a minimum tax imposed on individuals who earn substantial tax preferential income (e.g. capital gains) and/or claim certain exemptions, deductions, and tax credits in a year.

An individual will pay AMT if the individual’s ordinary tax is less than the AMT calculated for the year using an adjusted taxable income and a fixed minimum tax rate (currently 15%, federally).

AMT paid in the year can be carried-forward to reduce ordinary tax over the next 7 years if certain conditions are met. AMT not used in the subsequent 7 years expires and becomes a permanent tax. We find that the AMT is generally not fully recovered in the 7-year carry-forward period, making AMT a cost rather than just a prepayment of tax.

The calculation of AMT begins with adjusting taxable income by reducing certain deductions and including a larger portion of tax preferential income (i.e. capital gains) to determine taxable income for AMT purposes (“AMT Base”).

The AMT formula is comprised of 4 elements:

- AMT Base

- AMT Exemption (currently $40,000 for natural persons and Graduated Rate Estates [1])

- AMT Rate (currently 15%)

- AMT Tax Credits

The AMT calculation begins by calculating the AMT base, net of the AMT exemption, and then applying the AMT Rate net of. The resulting tax is reduced by certain non-refundable tax credits (“AMT Tax Credits”) to determine the individual’s AMT for the year.

Proposed Changes to the AMT Calculation after 2023

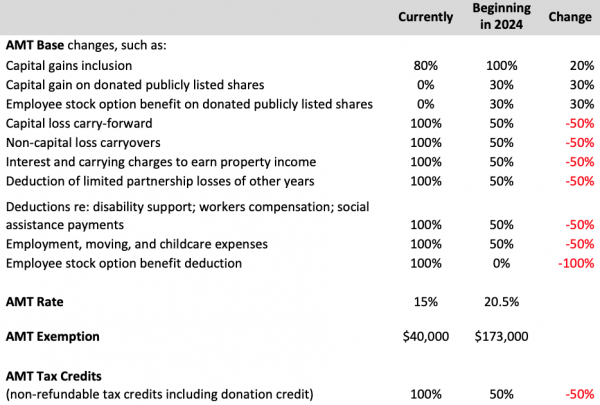

If passed as proposed, the following AMT changes will apply beginning in 2024 and affect all 4 of the aforementioned elements. The following table compares the current and proposed measures:

On the face of it, these changes look like they target individuals earning more than those affected by the current AMT rules since the AMT Exemption is increasing from $40,000 to $173,000. However, the other changes will make it easier to exceed the AMT Exemption.

The proposed changes will also make it even more difficult for taxpayers to apply their AMT carry-forwards against regular tax in the subsequent years.

Implications on Charities

While marketed as a quasi-wealth-tax the new AMT will prejudice charities by implicitly imposing a portion of the AMT on them in the form of reduced funds available from donors.

In particular, the increase in the portion of capital gains to be included in the AMT Base and the reduction in the donation credit by 50% in computing AMT Tax Credits will directly affect philanthropists and the charities they support.

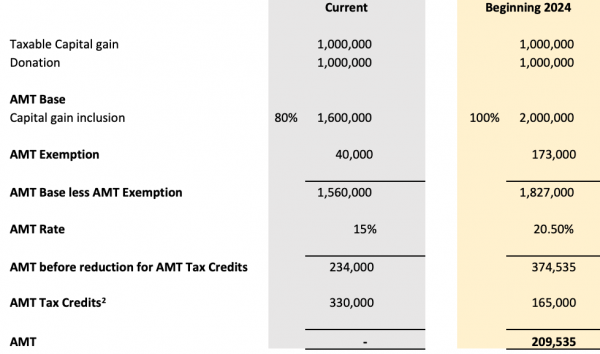

The following is a simple example comparing the current AMT with the proposed changes for an individual whose only income for the year is a capital gain of $2 million and has made a donation of $1 million in the same year.

Under the proposed rules, the individual in this example would be subject to AMT of $209,535 after 2023 but no AMT under the current rules. This result is due to the higher capital gain inclusion rate (100% vs 80%) in the AMT Base, the increase in the AMT Rate, and the 50% reduction in the donation tax credit in computing AMT Tax Credits.

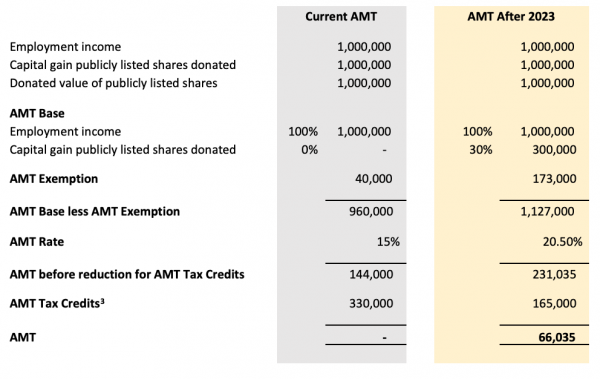

Individuals donating publicly listed shares after 2023 can be substantially impacted by AMT since 30% of the capital gain on donated publicly listed shares will be included in the AMT Base, even though none of it is taxable in computing the individual’s ordinary taxable income.

The following example assumes an individual earning $1 million of employment income donates publicly listed shares in the same year worth $1 million, of which the entire $1 million is an accrued capital gain:

The increase in AMT on larger donations is even more pronounced.

In our opinion, the inclusion of 30% of the capital gain on donated publicly listed shares, 100% of regular capital gains (up from 80%), and the reduction of the donation tax credit by 50% for computing AMT are punitive to philanthropic taxpayers and the charities they support. If provinces adopt similar changes the effects will be amplified. Charities may see reduced annual donations as some people may defer donations until death when AMT does not apply.

In some cases, people may avoid the increased AMT by donating through their investment companies since AMT does not apply to corporations.

These revised AMT rules come into force on January 1, 2024 so there is still time for taxpayers to make significant donations in 2023. Unless the proposals are revised, taxpayers may want to revisit their donation strategies.

———————–