taxpayers may need to act now

Prior to 2011, upstream loans were used to defer income offshore by having a foreign affiliate make a loan to a Canadian shareholder. In 2011, the government introduced upstream loan rules (grandfathered to take effect on August 20, 2016 for loans made prior to August 19, 2011) to curb indefinite offshore income deferral. Given these recent changes, the government’s focus on these types of loans and the impending end of the grace period many taxpayers may need to act now to ensure that their upstream loans will not attract adverse tax consequences.

Generally, the upstream loan rules require an income inclusion in Canada where a foreign affiliate of a Canadian taxpayer makes a loan to a person (or to a partnership) that is a “specified debtor” in respect of the Canadian taxpayer.

A “specified debtor” includes the taxpayer resident in Canada, and also a person who does not deal at arm’s length with the taxpayer, with the exception of a controlled foreign affiliate. A specified debtor also includes a partnership in which the non-arm’s length person and the taxpayer is a member.

There are certain exceptions to the upstream loan rules. For example, the rules do not apply to a loan that is repaid within 2 years of the day when the loan was made. The upstream loan rules will also not apply if the loan is made in the ordinary course of the business of the creditor, and bona fide arrangements were made for repayment within a reasonable time.

The introduction of upstream loan rules is similar to the domestic shareholder loan rule contained in subsection 15(2). However, the upstream loan rule is broader than subsection 15(2) because it is also applicable to Canadian corporations. This can often catch taxpayers off guard.

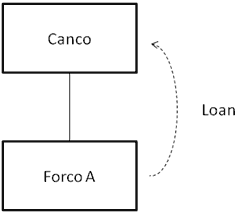

Consider the following example, where Canco wholly owns foreign affiliate A (Forco A):

In this example, Canco will have an income inclusion of the loan amount pursuant to the upstream loan rules if no other exception applies.

Certain loans are subject to a five-year grandfathered repayment period. If loans were entered prior to August 19, 2011, they will not be included as income as long they are repaid before August 19, 2016.

TAX TIP OF THE WEEK is provided as a free service to clients and friends of the Tax Specialist Group member firms. The Tax Specialist Group is a national affiliation of firms who specialize in providing tax consulting services to other professionals, businesses and high net worth individuals on Canadian and international tax matters and tax disputes.

The material provided in Tax Tip of the Week is believed to be accurate and reliable as of the date it is written. Tax laws are complex and are subject to frequent change. Professional advice should always be sought before implementing any tax planning arrangements. Neither the Tax Specialist Group nor any member firm can accept any liability for the tax consequences that may result from acting based on the contents hereof.